Document Verification Process In Bank

Neo world tech 112446 views. Railway bharti document verification process for group d alpntpcasm all post rrb recruitment duration.

Do you want to stick with standard credit data.

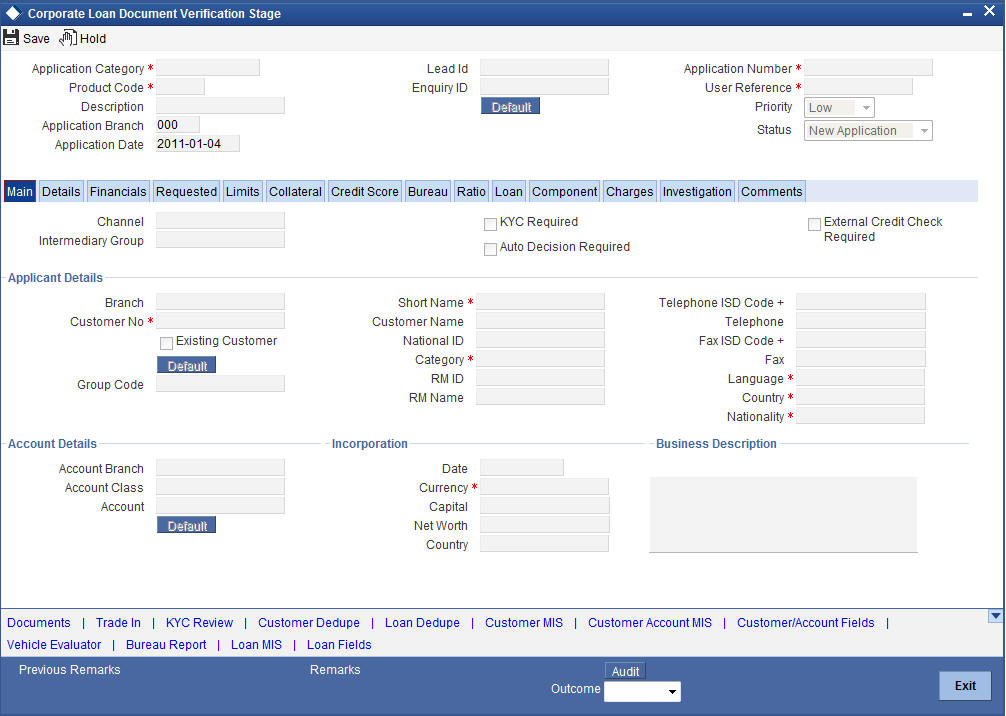

Document verification process in bank. To see what ally bank did wrong read this article. If the candidates fail to produce the necessary documents then their candidature will be cancelled. After the successful conclusion of the process you will receive a certificate stating the authenticity of your documents.

Document verification is an important step in the recruitment process. This video is unavailable. A representative from the team is sent to the borrowers place of residence to verify the address in person.

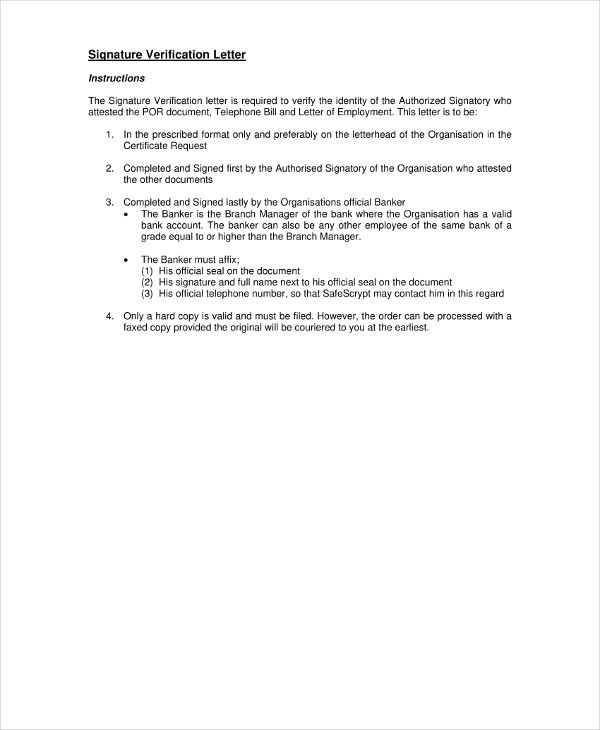

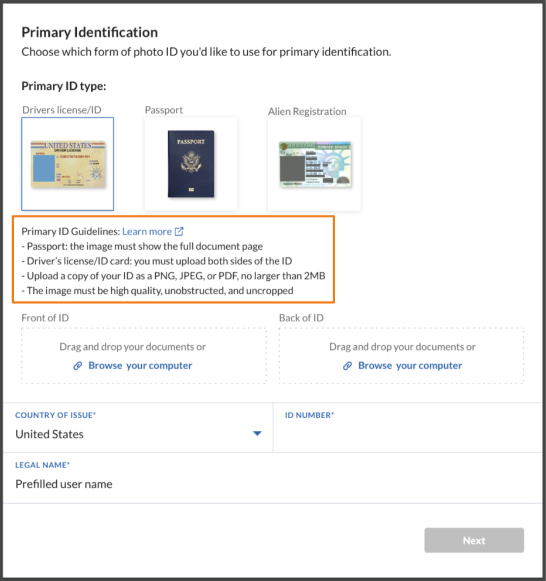

At the time of dv they fully support each andevery candidate. Hii no but keep your docs updated as mentioned in notification of exam. Because online identity verification is very fallable its important to put some thought into your institutions manual review process.

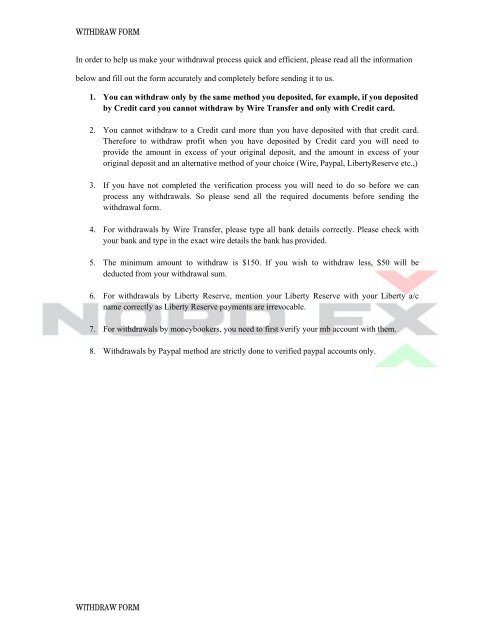

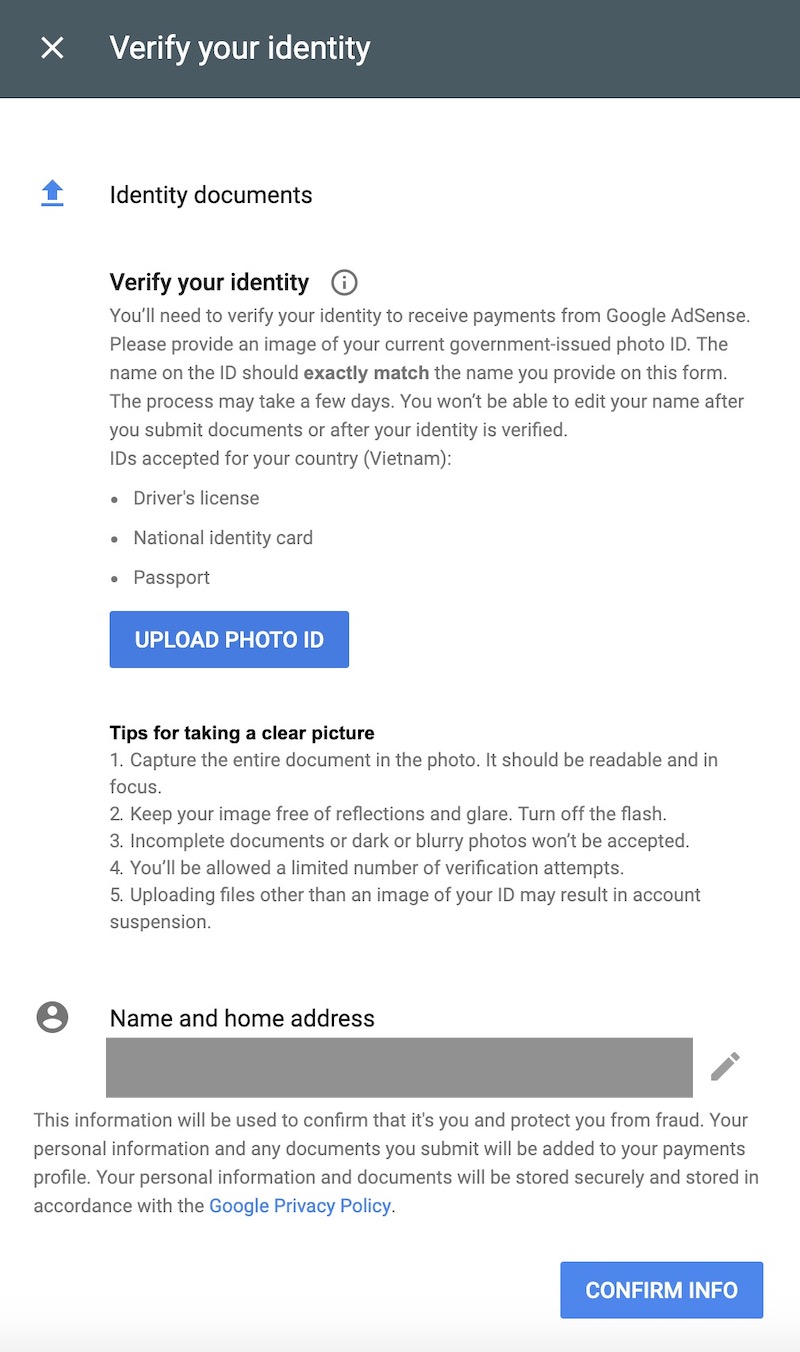

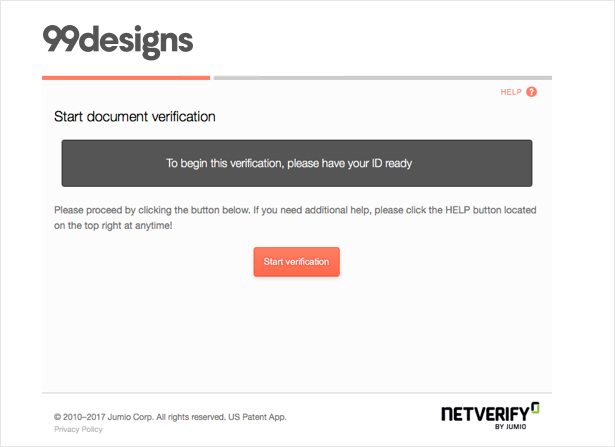

The bank takes 1 or 2 days to analyse the documents provided and forwards it to the verification department. The entire verification process will take about one month. Jumio enables your customers to quickly scan documents such as utility bills credit card statements bank statements and social security cards using their smartphones even if the documents are crumpled or creased.

For example that a bank statement showing funds are held by the applicant or a certificate showing a qualification was awarded a specific. They also visit the borrowers workplace and verify if the customer works with them. The most interesting aspect of identity verification is how much choice the financial institution has.

Explaining you the details of document verification process time it takes and major activitied involved in nepal from university education ministry consular section of foreign ministry and the embassy. Wire the application fee of 1000 rmb to the aps bank account mail all necessary documents to the aps office. Jumio document verification enables your customers to verify their address over the internet rather than in person.

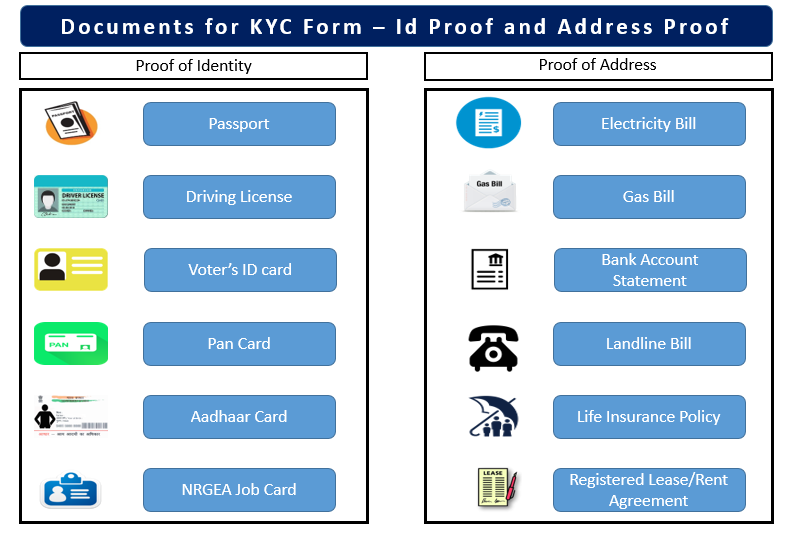

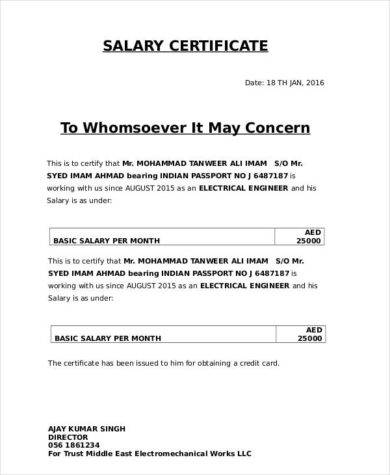

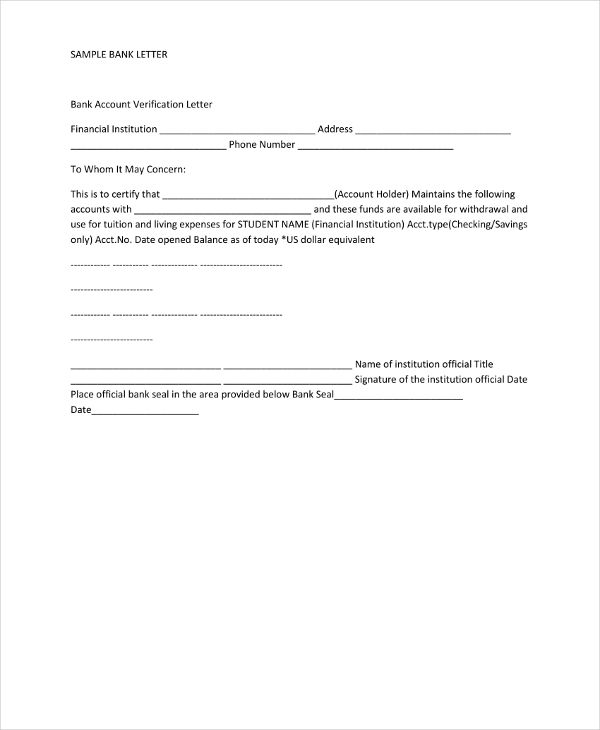

Document verification is the process decision makers use to check that a document provided by an applicant in support of their application qualifications funds sponsorship is genuine. Generally banks have a verification team of their own. All the realted docs and certificates are to be produced in original format it is the main requisite for ver.

Post a Comment for "Document Verification Process In Bank"